Can I Go into Retirement Early With FIRE?

Success

SEPTEMBER 15, 2023

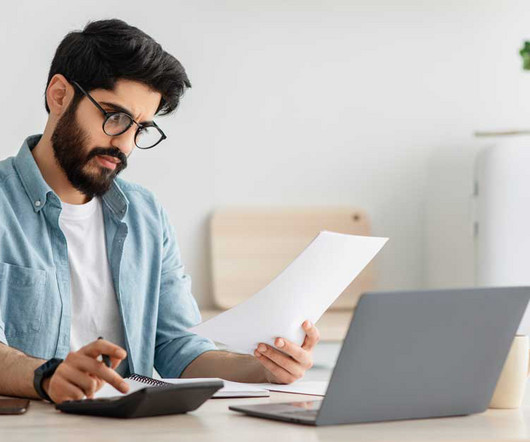

Do you dream of spontaneously traveling to a new place for a few months? If any of these scenarios sound ideal, you may be dreaming of a FIRE retirement lifestyle. What is the FIRE retirement movement? The primary goals behind the FIRE movement are to reach financial independence and retire early, often in your 30s and 40s.

Let's personalize your content