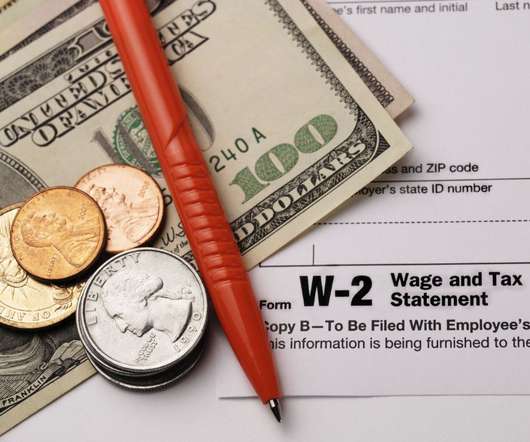

8 Crucial Tax Filing Tips For Freelancers

Allwork

JANUARY 11, 2023

who earn freelance income face confusing tax guidelines and difficult requirements for filing your own taxes. . It’s confusing and difficult, for most people, to know how you’re supposed to file your own taxes when freelance income has been earned from one-time jobs or contract work. . Health insurance . ” .

Let's personalize your content