Can Couples Combine Their Finances and Stay Together?

Success

FEBRUARY 20, 2023

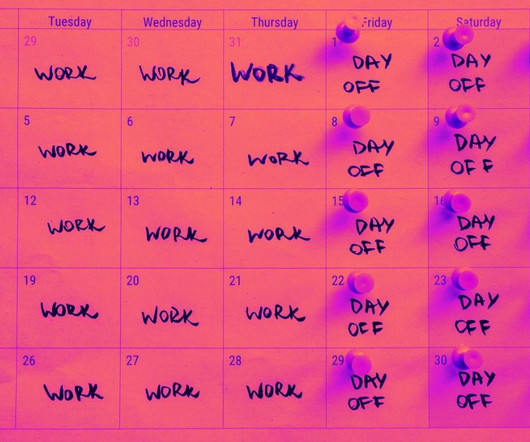

Deciding when and how to manage your finances as a couple can be a huge source of stress in a relationship. While discussing money is uncomfortable, it’s worse if you avoid talking about finances before saying ‘I do’ or signing a lease together. Combining finances pros It keeps things (relatively) simple.

Let's personalize your content