The Legal and Tax Complications Faced by Digital Nomads and Their Employers

Small Business Labs

APRIL 6, 2021

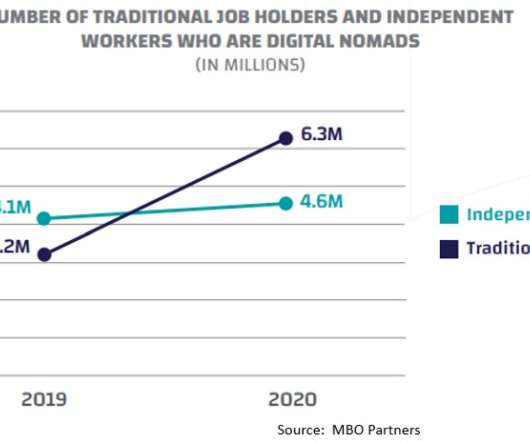

A quick summary of the article is if you're working remotely, it can be pretty complicated and potentially expensive from a tax perspective. But remote work is even more legally challenging for employers. We expect these numbers to grow again in 2021.

Let's personalize your content