Economists Issue Stark Warning: Trump’s Deportation Agenda Could Cost U.S. Economy $94 Billion A Year, Gutting American Workforce

Allwork

JULY 15, 2025

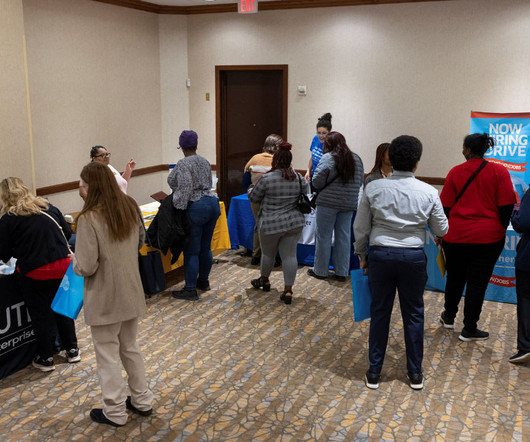

of the total labor force as of 2024 — has shrunk by 735,000 people since January, according to data from the Federal Reserve Bank of St. trillion between 2024 to 2034. born workforce is shrinking as many age out and retire. The foreign-born U.S. labor force — which made up 19.2% nominal GDP by $8.9 Meanwhile, the U.S.-born

Let's personalize your content