5 Tips to Make Filing Taxes Easier for Freelancers in 2023

Success

MARCH 13, 2023

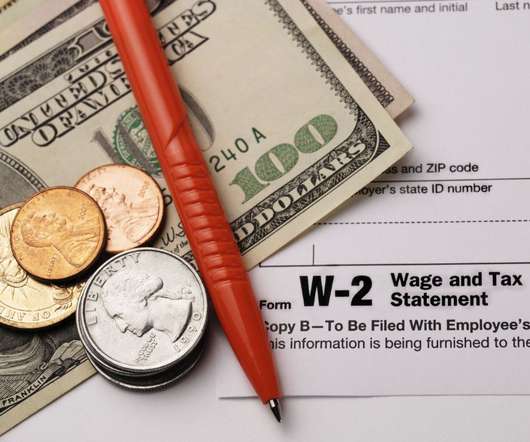

Generally, the expenses involved in operating your business or side hustle can be tax-deductible. So you can’t just go on vacation or buy a new car and claim it as a deductible business expense. That way, you don’t have to worry about your grocery expenses getting mixed up with your office rent come tax time.

Let's personalize your content