London Flexible Office Space Report - January 2024

Rubberdesk's Flexible Office Space Report examines actual flex office availability and pricing as well as trends in London.

Our Flexible Office Space Market Report for London provides a comprehensive breakdown of the current supply and pricing of the Greater London coworking and flexible office market.

"Thanks to a 43% surge in the availability of Flex offices in 2023, professionals in London have never had more choice when finding an office. Spurred by a mix of new serviced offices and larger managed spaces offered on longer terms by traditional landlords, such as British Land, we anticipate these spaces to drive demand throughout 2024.”

Jim Groves, CEO

Growth of the Managed Office Drives Up Available Flex Inventory to New Heights

Despite 4% of available stock being rented in October and November, overall supply across the Rubberdesk platform jumped a staggering 43% since the start of the year.

The growth was driven by substantial amounts of managed offices offered by Landlords. Offering services on top of space alone, Landlords and Management partners such as Kitt and Workplace Plus, fit out and package larger fully managed spaces. Offered on terms over 2-3 years, these offices have found traction with larger businesses who demand greater productivity, flexibility while still getting a bespoke product.

Central London continues to lead the premium office market with median monthly prices of £694 per desk, driven largely by high-demand areas in the City of London such as Mayfair, Marylebone, King's Cross, and Holborn, and a flight to quality trend as businesses seek desirable workspaces to bring teams together.

While desk rates have dropped 2% since the start of the year, prices have started to show resilience, up 2.6% to £625 since the end of Q3.

As ongoing inflation, low business sentiment and a challenging commercial real estate market continues to drag on the economy , we expect desk rates in London to remain steady with only minimal variance throughout the year.

Source: Rubberdesk January 1, 2024

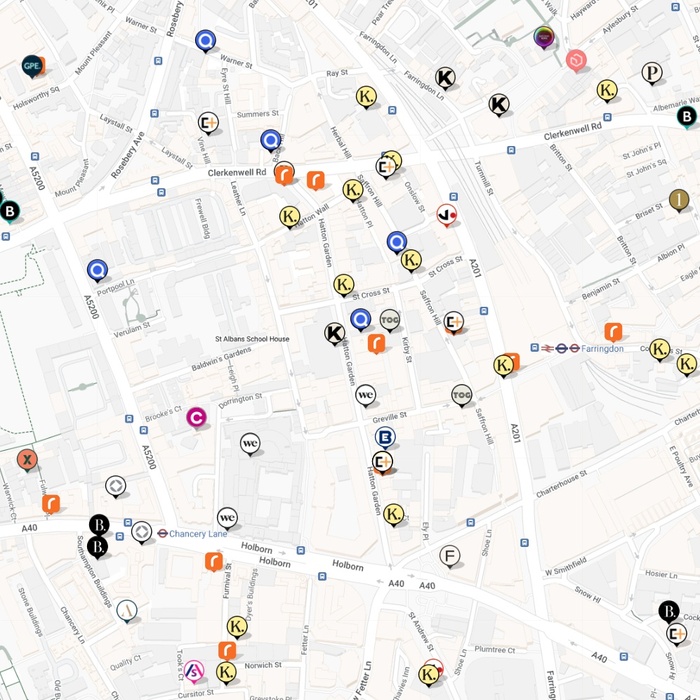

New Supply in Central London up 51% in 2023, Rates Stabilise

London's largest region, Central London encompasses Victoria in the West to King's Cross in the North and Southwark in the South giving businesses the widest variety of office space including size, quality, and price points of anywhere in Europe.

After 5 consecutive quarterly declines, desk rates in London gained 1.6% to £694 per desk thanks to high-demand areas like Mayfair and Holborn which both climbed 11% to £1,022 per and £725 per desk respectively. Desk rates in Fitzrovia retreated for a second quarter, down 7.3% to £662 per desk while King's Cross slid 6.6% to £639 per desk. With continued demand for Marylebone, desk rates were up 4% to £780 per desk.

With close to 4 million sq. ft. of available flexible office space in Central London, up 51% year over year, and a greater range of enterprise offices for teams of 26 or more there's more choice for larger spaces from traditional serviced office providers as well as new fully managed floors that provide more privacy and longer terms. While desk rates for smaller offices saw a 4% increase to £699 per desk, rates for larger offices was up 5% to £770 per desk.

Source: Rubberdesk January 1, 2024

East London Sees 14% Yearly Increase in New Inventory

As London's second largest region by available square feet, desk rates in East London remained flat at $450 per desk despite a 2.4% decline in overall supply. However, not all regions are created equal, and rates in Shoreditch and Wapping at £628 and £721 per desk remain on par with Central London.

For businesses looking for value, Whitechapel and Spitalfields continue to shine with median desk rates at £489 and £466 per desk. Meanwhile, Canary Wharf has seen a bit of a resurgence as desk rates returned to pre-pandemic levels at £450 per desk.

After dropping mid year, prices for smaller offices of 1 to 10 people gained lost ground with 1-4 person offices increasing 21% to £425 per desk while offices for 5 -10 people was up 9% to £380 per desk. While mid-sized offices for 16-25 staff fell 9.1% to £450 per desk, rates for enterprise offices of 50 or more saw a 1% increase to £550 per desk.

Finally, despite a 2.4% decrease since Q3, East London saw a 14% overall gain in availability to 527,950 square feet of office space since the start of the year.

Source: Rubberdesk January 1, 2024

North London: Rates Hit All-time Low as Supply Surges 11%

While prices are down across many areas of London, rates in West London have been relatively immune.

After seeing a 45% increase in much needed supply in Q1, available inventory in West London fell 2% from Q3 to 337,300 sq ft. Desk rates which had been on an upward trend through the first 3 quarters of 2023 fell 2% to end the year at £475 per desk, down from £484 in Q3.

Hillingdon and Ealing saw a modest 7% increase in rates to end the year at £333 and £300 per desk. On the other end, Fullham and Kensington & Chelsea helped bring the median rate down as desk rates fell 13% and 9% to £477 and £500 per desk respectively while Hammersmith at the top end remained flat at £544 per desk.

Smaller offices for teams of 5-10 saw the largest rate increases, up 10% to £444 as inventory fell 11% for these offices. Larger offices for teams of 26-50 remained the most expensive at £534 per desk, despite a 11% increase in available supply.

Source: Rubberdesk January 1, 2024

South London's Rising Desk Rates: Still a Hub of Affordable Office Space Options!

With median desk rates in South London rising 15% to £280 per desk, London’s vast South region still provides a variety of options for businesses looking to rent office space on a short term basis. While larger offices for teams of 15 or more staff are hard to come by, there is a wide variety of spaces for teams of 2 to 15 in in the boroughs of Wandsworth, Kingston upon Thames and Merton.

For smaller teams, Wandsworth & Putney have offices available for £425 per desk, while Merton has multiple options available for £225 per desk with access to the city via Merton Road and Wimbledon stations.

Further South West, desk rates for office space in Kingston upon Thames range from £127 for a 15 person office to £350 per desk for a 5-10 person office.

Source: Rubberdesk January 1, 2023

Available Inventory in North London Rises 10.8% in Q4

Consisting of over 200 offices, the North London region covers the entire mix of office sizes from over fifty 1-4 person offices to larger enterprise offices for 50 to 190 staff that include multiple meeting rooms at rates from £110 per desk for those on a budget to upwards of £600 per desk for spaces closer to the city.

With prime locations like King's Cross close to Central London, North London provides the best of both worlds for businesses looking to be close to the city without the same budget. Desk rates in Hackney and Haringey for example range from £550 to £375 per desk while offices in Islington have a median desk rate of £350. Harrow and Brent in North West London offer the most economical options for businesses to set up a secondary office for teams of 1 to 70 at a median rate of £125.

Like other regions across London, we’ve seen a surge in office spaces in the North London region added to the platform, with available space increasing 11% during Q4 and 31% since the start of the year.

Source: Rubberdesk January 1, 2024

Methodology

- All prices presented in this report are based on the median rate for a location or office size across an entire month

- Availability is based on the inventory inside the Rubberdesk platform and includes coworking desks and available offices that hosts share with Rubberdesk

- Actual Flex office availability may be higher as not all hosts share 100% of their unoccupied office space with Rubberdesk

Our Price Guides

- UK Flexible Office Space Report

- City of London Office Price Guide

- East London Office Price Guide

- Birmingham Price Guide

- Manchester Office Price Guide

- Scotland Office Space Price Guide

- Dublin Office Price Guide

About Rubberdesk

Rubberdesk is the UK’s flexible office marketplace with thousands of fully furnished serviced offices and coworking desks ready for you to move in and rent by the month or year. Since having launched in the UK in early 2020, the Rubberdesk platform now encompasses over 6,500 offices, an estimated 6 million sq. ft. of space with a capacity for over 120,000 people.

Rubberdesk’s proprietary platform combined with industry insights from their office specialists helps customers find the best office for their unique needs. With a view across all available options, they simplify the process to create a bespoke shortlist, arrange tours and negotiate the best deals. All for free and without obligation.

Rubberdesk provides Flex Powered by Rubberdesk for commercial agents across the UK.

Rubberdesk also operates in Australia and Ireland.

Media Information

For further information, images and interview requests, please contact Laura O'Sullivan at Rubberdesk:

- E: [email protected]

- T: 0800 699 0655