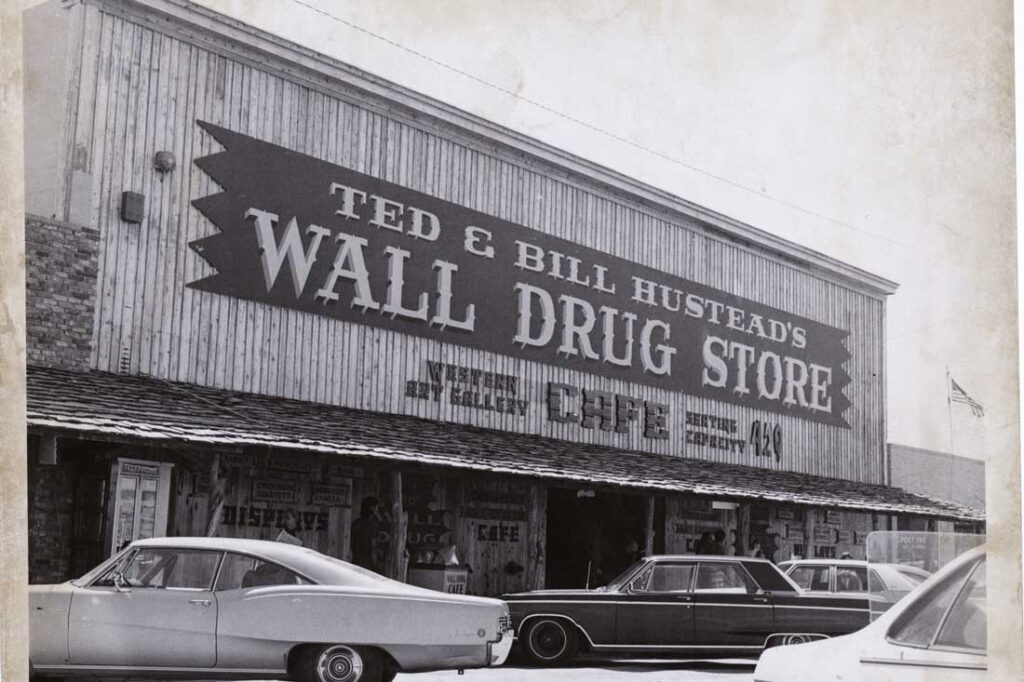

Millions of Americans were unemployed, a spate of bank runs swept the country, drought and dust storms ravaged the state—and yet none of that dissuaded one couple from opening a drugstore in a small South Dakota town in December 1931. Almost a century later, that store with humble beginnings has grown into one of the most iconic roadside attractions in the U.S.

Ted and Dorothy Hustead answered the call of entrepreneurship during the Great Depression. Wall Drug was by no means an overnight success, and the couple gave themselves five years to see out their vision as they awaited the completion of Mount Rushmore and, hopefully, a wave of tourists.

Those tourists started arriving—but not as customers. “There was a lot of talk about going broke,” says Rick Hustead, grandson of Ted and Dorothy and the third generation to run Wall Drug in his current role as chairman. His daughter, Sarah, is manager and vice president. “They weren’t doing hardly any business.”

In their fifth year of business in 1936, as Dorothy lay awake from the drone of traffic passing by Wall, she was struck by inspiration to post a series of signs along the road: “Get a soda… get a root beer… turn next corner… just as near… to Highway 16 and 14… free ice water… Wall Drug.”

As the legend of Wall Drug’s beginning goes, the first customers had already stopped into the store before Ted returned from putting up those signs. And the rest, it seems, is history.

To survive a recession, focus on profitability

While Wall Drug isn’t recession-proof, as Hustead notes, it has survived and thrived through more than a dozen economic downturns. Speculation of another impending recession battered the confidence of small-business owners, as indicated by monthly surveys conducted by the National Federation of Independent Business.

But other crises—the ones no economists can predict—have really tested Wall Drug at times.

Time and again, keeping the focus on profitability has been crucial to helping small businesses survive a recession. “You’ve got to be profitable to sustain a small, private business,” Hustead says.

Drawing on his 40-plus years with Wall Drug, and lessons he learned from older generations, Hustead shares advice for other small-business owners who may be tested by the next economic downturn or another unforeseen crisis.

The key to staying in business and being profitable, Hustead notes, requires regularly monitoring your overhead, labor, inventory expenses and revenue: “If you run out of money and go broke, you’re out of business.”

The impact of COVID-19

The COVID-19 pandemic dealt a blow to millions of small businesses, and Wall Drug was no exception. The store was forced to close for 70 days, so the Husteads had to lay off most of the year-round staff. “It was one of the hardest things that I had to do in my career,” Hustead says, adding that all furloughed employees were able to return to work by June 2020.

Still, the total headcount for the business was lower. To keep the 76,000-square-foot store running with only 120 employees, down 40% from the prior year, and with 50% fewer staff in the restaurant, they had to find efficiencies like streamlining the restaurant menu. By the time the “tourism floodgates” reopened in 2021, the Husteads had found ways to cut costs and learned to run the business with fewer staff than pre-pandemic years, making for the most profitable year in the store’s history.

Wall Drug’s tried-and-true tips to help you survive a recession

Plan for a recession before it happens

The store has been tested by other events over the past 50 years. A gasoline shortage in 1973 led to a 25% drop in business and profitability as fewer people crisscrossed South Dakota. A fire in the restaurant’s kitchen in April 2002 forced the owners to scramble to become operational again before the summer rush. They faced a costly repair after a water main line break in February 2013 sent 100,000 gallons of water rushing into Wall Drug’s basement and knocked out every single big power panel.

These types of dreaded, so-called “black swan” events are difficult to predict, so it’s important to have a plan in place before crisis strikes, advises Frank LaMonaca, a mentor with SCORE, a network of volunteer, expert business mentors. “Events that you can’t fathom will occur, and you need to plan ahead for those, even though you don’t know what that can be,” he says.

Don’t wait for the bad event to occur, LaMonaca urges. Instead, recession planning should be done at the onset of your business—or you should catch up ASAP—so you can draw on a plan B and a group of key professionals when disaster strikes.

Review finances regularly

While customers returned to Wall Drug fairly quickly after those COVID-era shutdowns, other challenges persist. Namely, Hustead must ensure that he remains a competitive employer by offering benefits and an hourly wage that will both attract and retain employees.

What’s more, in light of concerns about supply chain disruptions in 2022, Wall Drug increased its inventory “quite a bit,” which has tied up more of the business’ assets, a challenge Hustead has continued to grapple with this year. As a result, he began monitoring the company’s finances on a weekly basis.

A weekly cadence for reviewing financials is a good idea, particularly if economic conditions are tighter, things get “a little rocky” or the business is in early stages, advises Stephanie Sims, a member of the U.S. Chamber of Commerce’s Small Business Council. During “normal” times, that cadence could fall back to quarterly.

What does that look like in practice? “Regularly reviewing your financials and understanding which parts of your business are profitable, or close to profitable, and which parts of your business are actually pulling your profitability down,” Sims says, adding that such a review is particularly important for businesses that sell a wide range of products.

Pitch in often

As a fourth-generation family business, Hustead says Wall Drug strives to treat its employees like they’re part of the family, and some employees have even worked at the store for as long as 50 years. That loyalty and dedication, along with the employees helping the business through “a really tough time” during the pandemic, means the Husteads—Rick, his wife Patt and Sarah—feel it’s their obligation to pitch in during busy times.

“We’re here at the store a lot and working with our employees, and we think that’s what it takes for us to run the business well,” Hustead says. “My dad told me: ‘Rick, if you want the restaurant to run well, be in the restaurant.’ Great advice.”

Keep customers close

Wall Drug sees an estimated 50% of business come from repeat customers, so employees play a valuable role in the overall business. “You can’t run a business without staff,” Hustead says. “I have to think part of the reason that our employees do such a good job with customer service is we emphasize how important it is, and they deliver on it.”

Employees can also be an important resource when problems arise, and they may be able to help identify changes among your customer base, notes Elizabeth Gore, president and co-founder of Hello Alice, a free platform for small-business owners that offers networking, learning and funding opportunities. “Customer behavior can get willy-nilly in a recession or prerecession,” she says, adding that that may include changes in how people spend money, whether they’re frequenting stores or buying online, and whether they opt for short- versus long-term contracts with service providers. That’s why it’s “very, very important to stay close to your customers” so you can pivot, she notes.

Keep lines of communication open with employees and vendors

Finally, you need to establish a two-way dialogue with employees, especially if your business is faltering, LaMonaca recommends. Lay out your preexisting plan for such an event, engage with your employees to find solutions and err on the side of more, rather than less, communication. “Rumors are going to go quickly throughout your employee group when things are difficult, and those rumors are worse than the truth,” he says.

Hustead can draw upon the vision of generations past and present when making key business decisions. Beyond family, he says the accountant Wall Drug has been working with for years has served a valuable role as an adviser and is very helpful to the business.

Likewise, LaMonaca’s recommendation of establishing relationships with a team of professionals—a banker, an accountant, an insurance agent and a lawyer—is important to do early in your business tenure so you can lean on them through these periods of uncertainty. Reaching out to a free SCORE mentor can also be helpful, LaMonaca says: “We are not judgmental; we are accessible; we’re kind of a safe place for people to go when they’re under stress.”

Ensuring you have a solid relationship with your bank and understanding what services it has available can also be key to business survival, Gore says. Those resources might include lines of credit, small-business loans, small-business grants and operational credits. “Walk into the branch of your bank and actually establish a relationship with your banker before the whole world needs them,” she says.

Know that other businesses are in the same boat

The reality of a recession is that other businesses you interact with may be going through some of the same challenges at the same time, and this shared experience can be helpful. To feel less isolated, Gore recommends engaging with business groups in your area, such as those run by your local Chamber of Commerce, or seeking out peer-to-peer mentorship opportunities or webinars.

As Wall Drug has proven, even the worst financial crisis in U.S. history couldn’t stop a successful idea—and nor could the other serious tests of the business that followed.

Likewise, small-business owners who endured the pandemic have been tested by a range of challenges, including natural disasters, power or utility disruptions and staffing issues, Gore says. “Those who made it through the last five years are going to be incredibly strong—they’ve had to go through a lot,” she continues.

Finally, as has been the case since 2020, another recession could lead to more small-business formation. “This is fertile ground for the next great wave of innovation,” Sims says.

“History shows businesses and entrepreneurs who launch during times of crisis tend to be incredibly resilient and very smart about their assets, so I have a lot of optimism about the new folks launching right now,” Gore adds.

Prepare now to survive a recession

It can take time to get recession-ready if you’re not yet. It will include having a solid understanding of your core costs so you can increase (and diversify) cash flow and building strong relationships with key professionals who will help during a crisis. By carving out dedicated time each day or week, Gore estimates small-business owners can get a plan in place within a month—and ultimately increase position themselves to survive a recession.

“The biggest weakness people have here is taking the time to do it,” she says, adding that she “guarantees” it will support dividends to do so. “This is not an ‘I’ll get to it when I can;’ it’s not an afterthought.”

Regularly reviewing your profit and loss statement will help you understand your financial situation, so you can pivot as necessary. “Don’t ignore the reality hoping that it’s just going to get better,” Sims says. “If you’re going into a period where things are going to get tighter, the best thing you can do is improve your gross margin first; only sell things where you know you make money and where you’re making the most money at the gross margin level.”

Finally, consider the personal toll a decline in business can have, including if you’ve intermingled your personal and business finances, Sims says.

Taking care of your mental health is also important during periods of stress, notes Gore.

LaMonaca recommends asking yourself and your team two questions: What can we control? What can’t we control? Once you have a plan in place to tackle what you can control, keep at it, he says: “Nothing takes the place of being persistent.”

This article originally appeared in the July/August 2023 issue of SUCCESS magazine. Photo courtesy of Wall Drug Store.