Why File Form 2290 Online?

Small Business CEO

JULY 13, 2021

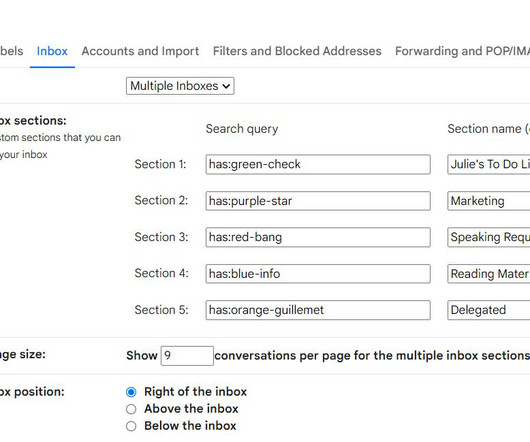

If you are into the trucking business, you must be aware of form 2290 and Heavy Vehicle Use Tax (HVUT). The IRS mandates that every person who owns a heavy highway motor vehicle weighing 55,000 pounds or more and covered 5,000 miles or above in the odometer file form 2290 and make the HVUT payment.

Let's personalize your content