5 things you should do now to prepare for year-end payroll reporting

BMT Office Administration

OCTOBER 6, 2022

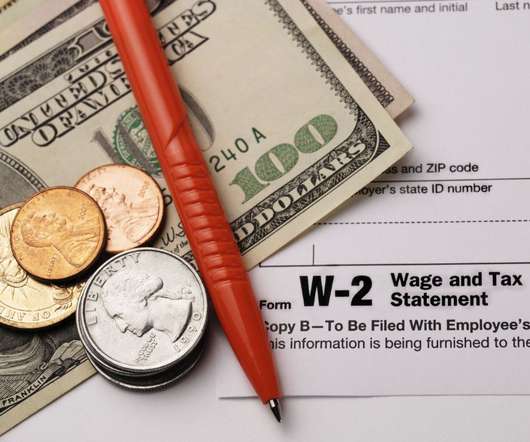

However, Payroll teams are busy preparing for a different season — year-end reporting. Even though time is ticking down, it would be prudent to act as if the IRS will issue these regs in time for 2023 filing. Send independent contractors Form W-9 to capture their SSNs and addresses. Test your systems for 2022 filing.

Let's personalize your content